In today's world, developing an app can cost you an arm and a leg, but what if we told you that you could build a low-code Fintech app without breaking the bank? Yes, you heard it right! With the advent of low-code development platforms, building a Fintech app has become easier and less expensive. But hold on! Just because it's low code doesn't mean it's low quality. In fact, with the right approach, you can create a robust and scalable Fintech application that can compete with the big guns.

In this article, we'll guide you through the process of building a low-code fintech application without compromising on functionality, security, or user experience. We'll cover everything from choosing the right low-code platform, understanding the fintech landscape, designing a user-friendly interface, and much more. So, buckle up and get ready to dive into the world of low-code fintech app development.

What is Fintech?

Fintech, shortened from Financial Technology, is the buzzword that's been shaking up the financial industry in recent years. It refers to the use of technology to provide financial services that are faster, cheaper, and more convenient than traditional financial institutions.

Fintech covers many services, including mobile payments, online banking, lending, investment, and insurance. It leverages cutting-edge technologies such as blockchain, artificial intelligence, and machine learning to streamline processes, reduce costs, and enhance customer experience.

The rise of Fintech has opened up a world of possibilities for consumers, allowing them to access financial services anywhere in the world with just a few taps on their phones. At the same time, it's also challenging traditional financial institutions to adapt and innovate to stay relevant in the rapidly changing landscape.

Here are some of the main areas of Fintech:

- Payments and Transfers: everything from traditional payment systems like credit cards and bank transfers to newer mobile payment systems like Apple Pay and Google Wallet.

Lending and Financing: peer-to-peer lending platforms, crowdfunding platforms, and online lenders that provide loans and financing to individuals and businesses. - Personal Finance and Wealth Management: digital tools and platforms that help individuals manage their finances, track their investments, and plan for their financial future.

- Insurance: digital insurance platforms that provide coverage for everything from home and auto insurance to travel and health insurance.

- Blockchain and Cryptocurrencies: decentralized platforms and digital currencies like Bitcoin and Ethereum that use blockchain technology to facilitate secure and transparent financial transactions.

- Regtech: digital tools and platforms that help financial institutions comply with regulatory requirements and manage risk more effectively.

- Trading and Investments: digital trading platforms and robo-advisors that provide automated investment advice and management.

One of the key advantages of Fintech is its ability to streamline processes and reduce costs. Using technology, Fintech companies can automate many of the manual processes that traditional financial institutions rely on, such as paperwork and manual data entry. This not only reduces the time and effort required to perform these tasks but also reduces the risk of errors and fraud.

Another key aspect of fintech is its focus on innovation. Fintech companies are constantly experimenting with new technologies and business models to find more efficient and effective ways of delivering financial services. This has led to the development of new products and services previously unavailable or unaffordable to many consumers.

Low-code No-code Essentials: from Basics to Pro

If you're a developer looking to speed up the development process, low-code platforms are your new best friend. These platforms offer pre-built components and an intuitive interface that lets you drag and drop elements to build your application faster. You can even customize the components to fit your specific needs.

The story of low-code and no-code platforms began in the early days of software development when developer had to wrtie code. This process was time-consuming and often required a team of developers to work on a single project.

In the early 2000s, the concept of model-driven development (MDD) emerged, which aimed to streamline software development by using visual models to generate code automatically. This approach was further developed into what is now known as low-code development, which uses a drag-and-drop interface to build applications quickly and easily without requiring developers to write code manually for every aspect of the application.

Around the same time, the concept of no-code platforms appeared, which aimed to make application development accessible to non-technical users. No-code platforms provide a visual interface and pre-built components that users can drag and drop to create custom applications without writing code.

In recent years, low-code and no-code platforms have become increasingly popular due to their benefits, such as faster development time, cost savings, and greater collaboration between developers and non-technical stakeholders. They have also evolved to become more sophisticated, offering more advanced features and integrations with other tools and technologies.

Today, low-code and no-code platforms are used in various industries, including fintech, healthcare, education, and more. They are also being embraced by both experienced developers and non-technical users, as they provide a powerful and flexible tool for building custom applications quickly and easily.

Another benefit of low-code and no-code platforms is greater collaboration between developers and non-technical stakeholders. Because these platforms provide a visual interface, stakeholders can better understand the application's functionality and provide feedback in real time. It leads to better communication and more effective collaboration between team members.

Why Low-Code Becomes Popular in Fintech

Did you know that low-code development is taking the fintech world by storm? It's true!

Competition in the financial services industry is increasing, and today's influx of non-banks makes it tougher than ever. Many of these Fintech institutions are beginning to absorb the traditional financial institutions' market share for products and services at unprecedented levels, and they're doing so by offering a first-class end-to-end online customer experience.

Low-code solutions address these challenges by allowing non-engineers and designers to create end-to-end customer experiences using modern technology frameworks. With low-code solutions, financial institutions can build applications that meet their needs using drag-and-drop tools, eliminating the need for an off-the-shelf solution that doesn't support their processes and workflows.

Here are a few more reasons why low-code becomes popular in Fintech:

-

Faster Time-to-Market: Building an application from scratch can take months, if not years. With low code, you can build custom applications in a fraction of the time it would take with traditional development methods. This means that fintech companies can get their products to market faster and stay ahead of the competition.

-

Cost Savings: Traditional development methods can be expensive, especially when you factor in the cost of hiring a team of developers. With low code, you can build applications with fewer resources, which translates to cost savings for fintech companies.

-

Increased Efficiency: Low-code platforms provide pre-built components and templates that can be customized to fit your specific needs. This means that developers can focus on building the core functionality of the application rather than spending time on repetitive tasks like setting up the user interface.

-

Better Collaboration: Low-code platforms provide a visual interface that allows developers and non-technical stakeholders to collaborate more effectively. This means that everyone can have a better understanding of the application's functionality, leading to better communication and more effective collaboration.

-

Greater Flexibility: Low-code platforms offer greater flexibility than traditional development methods. Developers can quickly and easily change the application as requirements evolve without needing to write new code from scratch.

Low-code technology is transforming the banking experience and, in turn, can create opportunities for financial institutions to gain a significant competitive advantage in the marketplace, both today and in the future.

Prototyping a Fintech App with Low-Code

To be able to develop the application as quickly as possible, the customers need to have a clear understanding of what they want to get as a result, why this service is needed, and what goals it needs to achieve. It's great if you have a fully developed description of the business logic and functionality of the future MVP in terms of reference, text, graphic description, low-level screen layouts, wireframes, and clickable prototypes. All of this will allow better synchronization of the interaction between you and the development team.

If we are talking about a launch within a few weeks, then most likely, it will be either low-code development options or a web view-based product. It is quite possible to use a template ready-made solution based on low-code when it is necessary to adapt minimally - and within a few weeks, this is real. When developing an MVP from scratch, you should expect a period of 1-2 months to create an individual solution natively or cross-platform.

Prototyping a fintech app with low code is a super easy and fun way to build a working model of your application without doing a ton of coding. Here are the basic steps you can take to get started:

-

Figure Out What You Want: Before you dive into building your prototype, it's important to figure out what you want your app to do. This means identifying the main features and functions you want to include, as well as any bells and whistles you might want to add later.

-

Choose a Low-Code Platform: There are many low-code platforms out there, so pick one that fits your needs. You'll want to look for a platform that has the features and functionality you need, plus any other tools or integrations that will make your life easier.

-

Build Your Prototype: Once you've got your requirements down and your platform picked out, it's time to start building! Use the low-code platform to create a basic user interface and start adding the core features you identified earlier. Don't worry about making it perfect immediately—you can always iterate and improve later.

-

Test and Refine: Once you've got a working prototype, take some time to test it out and make sure everything's working as it should be. You might find some bugs or issues that need fixing, or you might come up with some cool new ideas for features or functions to add. Either way, keep iterating and refining until you're happy with your prototype.

-

Share and Get Feedback: Finally, share your prototype with others and get some feedback. This can include your team members, potential customers, or even industry experts. Use their input to make further refinements and improvements until you've got a final version that everyone loves.

All of these steps are quite easy to follow. You can prototype your fintech app using low code in no time, which means you can test out your ideas and make sure they work well without spending a ton of time or money on coding.

Comparing Expenses in Low-code Development vs. Traditional Development

Building a fintech app can be pretty pricey, but with low-code development, you can save some money compared to traditional development.

With traditional development, you usually need a whole team of developers to write custom code from scratch. This can take a lot of time and money, especially if you need to hire external developers or consultants. Plus, traditional development often involves a ton of testing and bug fixing, which can add even more expenses.

On the other hand, with low-code development, you can build your app using pre-built modules and drag-and-drop interfaces. This means you can save a ton of time and money on coding, and you don't need as big of a team to get the job done. Plus, low-code platforms often come with built-in testing and debugging tools, so you don't have to worry as much about those expenses.

Let’s see the main differences in terms of the main resources needed for the development process.

| Low-Code Development | Traditional Development | |

|---|---|---|

| Time | Faster | Slower |

| Cost | Lower | Higher |

| Team Size | Smaller | Larger |

| Customization | Limited | High |

| Testing and Debugging | Built-In | Extra Expenses |

| Learning Curve | Shorter | Longer |

As you can see, in low-code development, you can build your fintech app faster and with a smaller team, which can save you time and money. However, the level of customization you can achieve with low-code platforms may be limited compared to traditional development. You can develop a working web app with low code in just 1-3 weeks, while traditional development requires hardcore coding and may take about 2-8 months to complete.

Traditional development requires a larger team and more time and money investment but can offer more customization options. Low-code platforms also come with built-in testing and debugging tools, while traditional development may require additional expenses for testing and bug fixing. Additionally, the learning curve for low-code development is usually shorter than for traditional development.

Regarding expenses, you can have a fully functional business app for $36-$50 using the low-code platform (depending on the platform’s plan), while traditional development can cost between $40,000 to $100,000+, depending on the complexity of the project.

Steps to Make Low-Code Fintech Apps Less Expensive

Let’s see how we can use low-code for Fintech apps to make the development less expensive.

Step 1: Define Your Objectives and Requirements

First things first, you need to define your objectives and requirements for your fintech app. What problem are you trying to solve? Who is your target audience? What features and functionality do you need? By clearly defining your objectives and requirements, you can ensure you're using the right low-code platform and tools to build your app.

Step 2: Choose the Right Low-Code Platform

Choosing the right low-code platform is crucial for making your fintech app less expensive. Look for a platform that offers the features and functionality you need, as well as integrations with other tools you might use. Consider factors like pricing, support, and ease of use when deciding.

Step 3: Use Pre-Built Modules and Templates

One of the biggest advantages of low-code development is that you can use pre-built modules and templates to save time and money. Rather than writing custom code from scratch, you can drag and drop pre-built components into your app. This can help you get your app up and running faster and with fewer resources.

Step 4: Collaborate and Iterate

Collaboration and iteration are key to making your low-code fintech app less expensive. Work closely with your team and any external partners to identify areas where you can save time and resources. Test your app early and often, and use user feedback to refine your app over time.

Step 5: Monitor and Optimize

Finally, make sure to monitor and optimize your app over time. Use analytics and user feedback to identify areas where you can improve your app's performance and functionality. By continuously monitoring and optimizing your app, you can keep costs down and ensure that your app meets the needs of your users.

Best Low-code No-code Platforms for Fintech

Now, you might be wondering which low-code no-code platforms are the best for Fintech. We've compiled a list of some of the best platforms out there to help you build the perfect Fintech app. From drag-and-drop interfaces to pre-built templates and integrations with other fintech tools, these platforms have everything you need to build an app that will impress your users and streamline your Fintech operations. Here are some of the best platforms we can recommend:

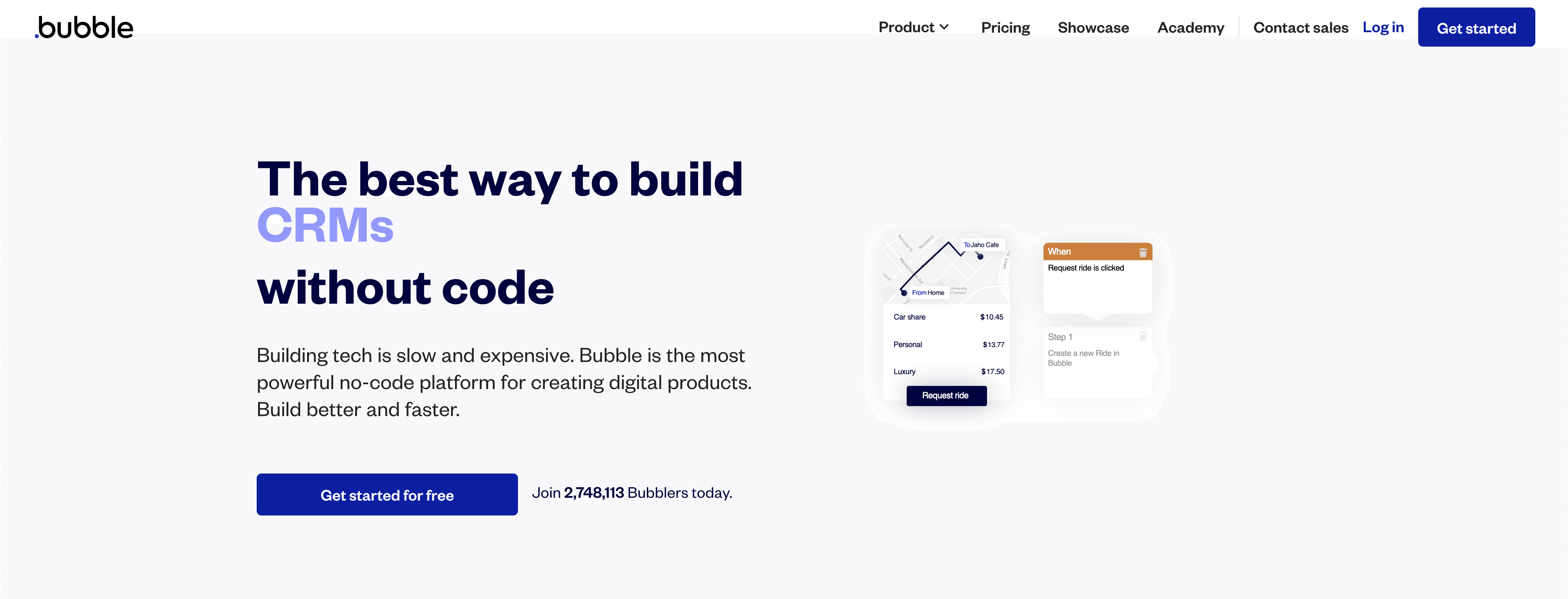

Bubble : a powerful no-code platform that allows you to build complex fintech applications without writing any code.

Here are some of the features that make Bubble a great choice for Fintech:

- Drag-and-Drop Interface makes it easy to create complex Fintech applications without writing a single line of code. You can simply drag and drop elements onto your page and customize them to your liking.

- Pre-Built Templates: offers a variety of pre-built templates for fintech applications, such as payment processing, financial tracking, and budgeting tools. These templates can help you get started quickly and inspire your own custom app.

Integrations: it integrates with a wide range of other fintech tools, such as payment gateways and accounting software, making it easy to create a fully functional fintech application with all the features you need.

AppSheet: a low-code platform that lets you create custom apps for fintech quickly and easily. With AppSheet, you can connect to various data sources, such as Google Sheets and Salesforce, and build fully functional apps without coding. Here are some of the key features:

- Flexible Data Integration: you can easily integrate data from a wide range of sources, including spreadsheets, databases, and APIs. This makes it easy to build fintech apps incorporating data from multiple sources.

Mobile-First Development: it is designed with mobile development in mind, so you can easily create fintech apps optimized for mobile devices. This is particularly useful for fintech apps that require users to be able to access and use them on the go. - Automation and Workflow Management: it offers powerful automation and workflow management features that can help streamline your fintech operations. You can automate repetitive tasks and build workflows that ensure data is processed accurately and efficiently.

OutSystems: a low-code platform that enables you to build enterprise-grade fintech applications in a fraction of the time and cost of traditional development. It provides a visual development environment, pre-built templates, and AI-powered tools to help you build your app quickly and easily. Here are some of the key features:

Visual Development Environment: it provides a visual development environment that makes it easy to build complex fintech applications without writing any code.

Mobile Optimization: it is designed to be mobile-friendly, so you can easily create fintech applications that work seamlessly on both desktop and mobile devices. You can customize the look and feel of your app to ensure that it looks great on any device.

- Cloud Deployment: it is a cloud-based platform, which means that your fintech application can be deployed quickly and easily without complex infrastructure.

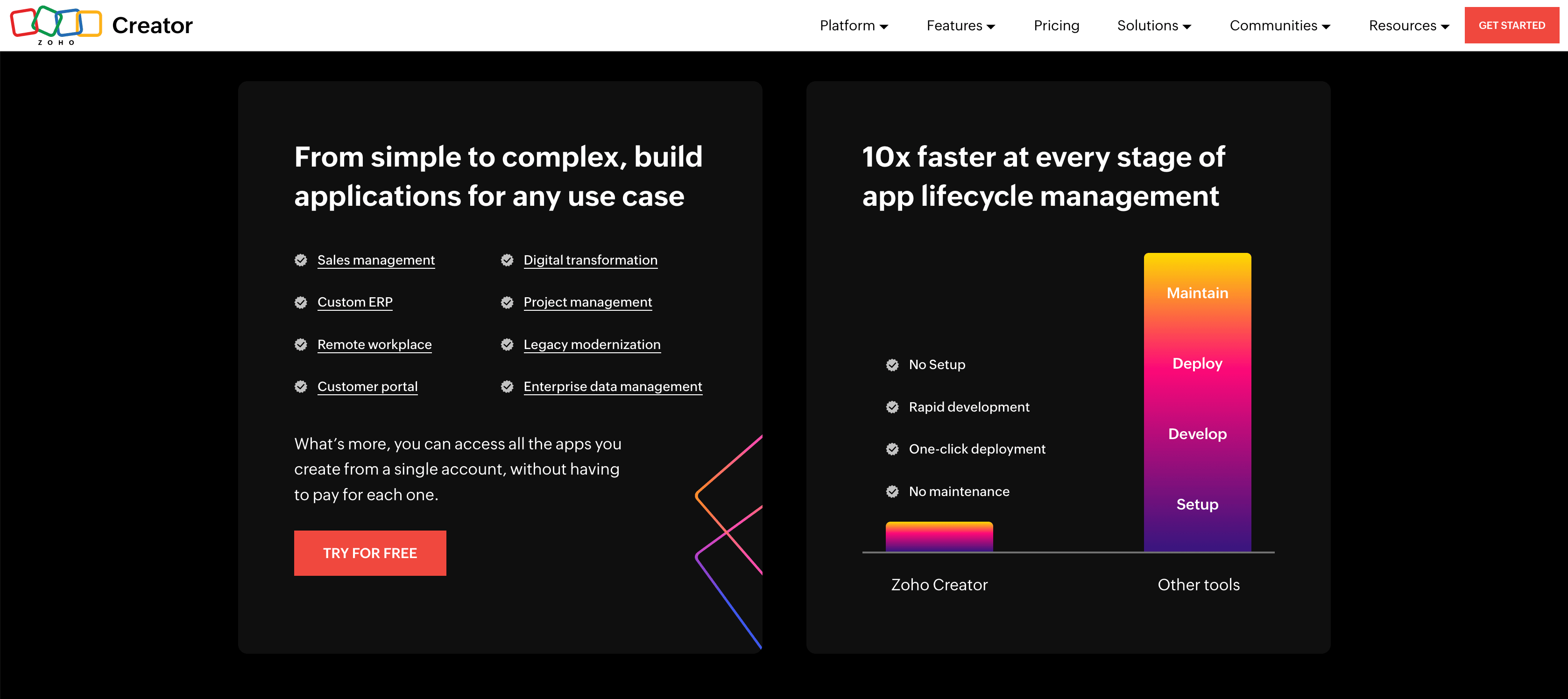

Zoho Creator: a low-code platform that lets you build custom fintech applications without coding.

It provides a drag-and-drop interface, pre-built templates, and a variety of integrations with other fintech tools, making it a powerful option for building fintech apps. Here are some of the key features:

- Pre-built Templates: it offers a variety of pre-built templates for common fintech use cases, such as invoicing, payment tracking, and budgeting. This saves you time and effort, as you don't have to start from scratch when building your app.

- Integration with Zoho Apps: it integrates seamlessly with other Zoho apps, such as Zoho CRM and Zoho Books. This makes it easy to create a comprehensive fintech ecosystem within the Zoho platform.

Security Features: it offers a range of security features, including secure authentication and authorization, data encryption, and compliance with industry standards like GDPR and PCI-DSS.

When choosing a platform, consider your specific needs and requirements, as well as factors like pricing, support, and ease of use.

Conclusion

Low-code platforms have revolutionized the Fintech industry by making it more accessible and affordable for businesses of all sizes to build their own applications. Using a low-code platform like Bubble, AppSheet, OutSystems, or Zoho Creator, you can prototype and launch your fintech app quickly and cost-effectively.

Let’s say you want to build a personal finance app to help people track their expenses and save money. Using a low-code platform like Bubble, you can drag and drop pre-built elements and customize them to create a polished, professional-looking app in a few days. Not only does this save you time and money compared to traditional development methods, but it also allows you to iterate quickly and respond to user feedback.

Low-code platforms are a game-changer for Fintech development. If you want to use a low-code platform to build the Fintech app of your dreams without breaking the bank, the Rabbitpeepers team is always ready to consult you and help with the development.