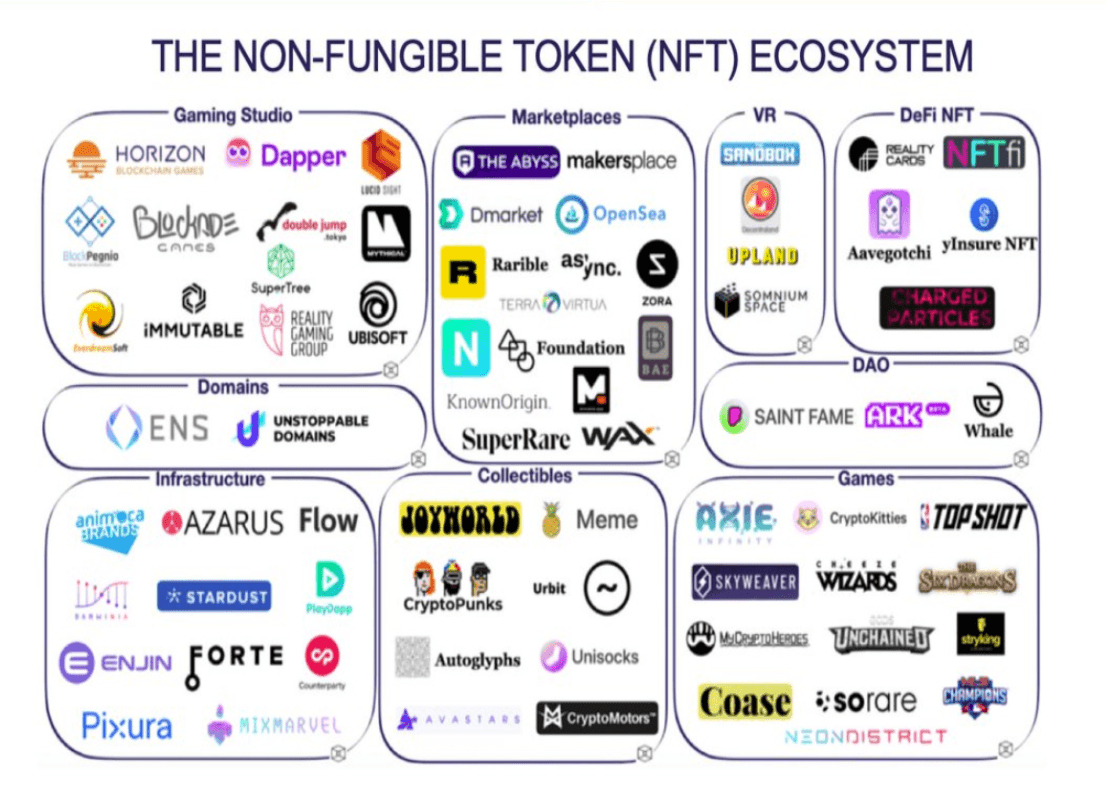

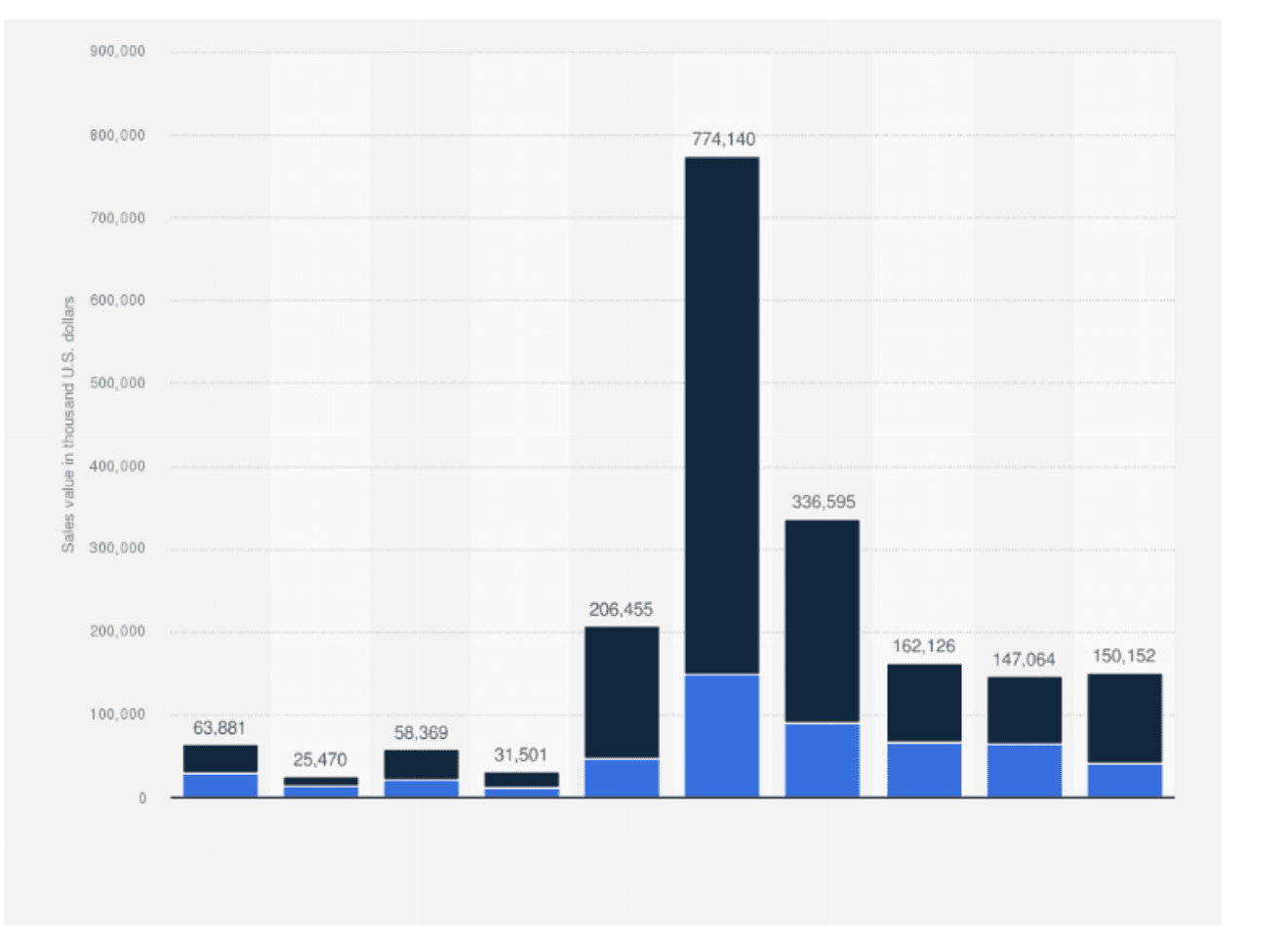

NFT tokens have become more popular among corporate and retail companies, initiating their revolutionary impact in the sphere of gaming and virtual collection. As for January 2022, the aggregated sales value of NFTs amounted to about $22 billion.

In this guide, we'll take a look at different types of non-fungible tokens, the specific of their work, their connections with DeFi, and main NTTs predictions for 2022.

What Is a Non-Fungible Token (NFT)?

Non-fungible tokens (NFTs) are cryptographically unique tokens on a blockchain containing unique identification codes recorded in smart contracts. This information makes each NFT unique and cannot be directly substituted for another token. NFTs cannot be exchanged for something similar, as no two NFTs are the same.

NFT technology’s first realization started in 2017 and was based on Ethereum smart contracts.

The first piece of art to be converted into an NFT token was a black and white stencil by Banksy called Morons (White). Blockchain company Injective Protocol bought it, burned it, and created an NFT token - a virtual asset linked to a “digital image of an art object.”

For creative people, NFT is a way to monetize their skills and expand their audience. Due to the lack of logistics difficulties, it is easier to sell artworks digitally than offline.

Among the benefits of NFTs, we can name:

- You can buy/sell tokens on particular sites, and the more unique the copy, the more valuable it is.

- The copyright will remain forever.

- The authenticity of NFT is completely ensured because you can't forge it.

- You can expand economic opportunities in games and other systems.

- You can earn royalties every time the NFT is sold.

How to create your NFT?

To create your own NFTs, you're going to need:

- Your piece of artwork, collectible, video, song, etc.

- A crypto to pay the minting fee;

- A cryptocurrency wallet for your crypto;

- The blockchain where you can create your NFT.

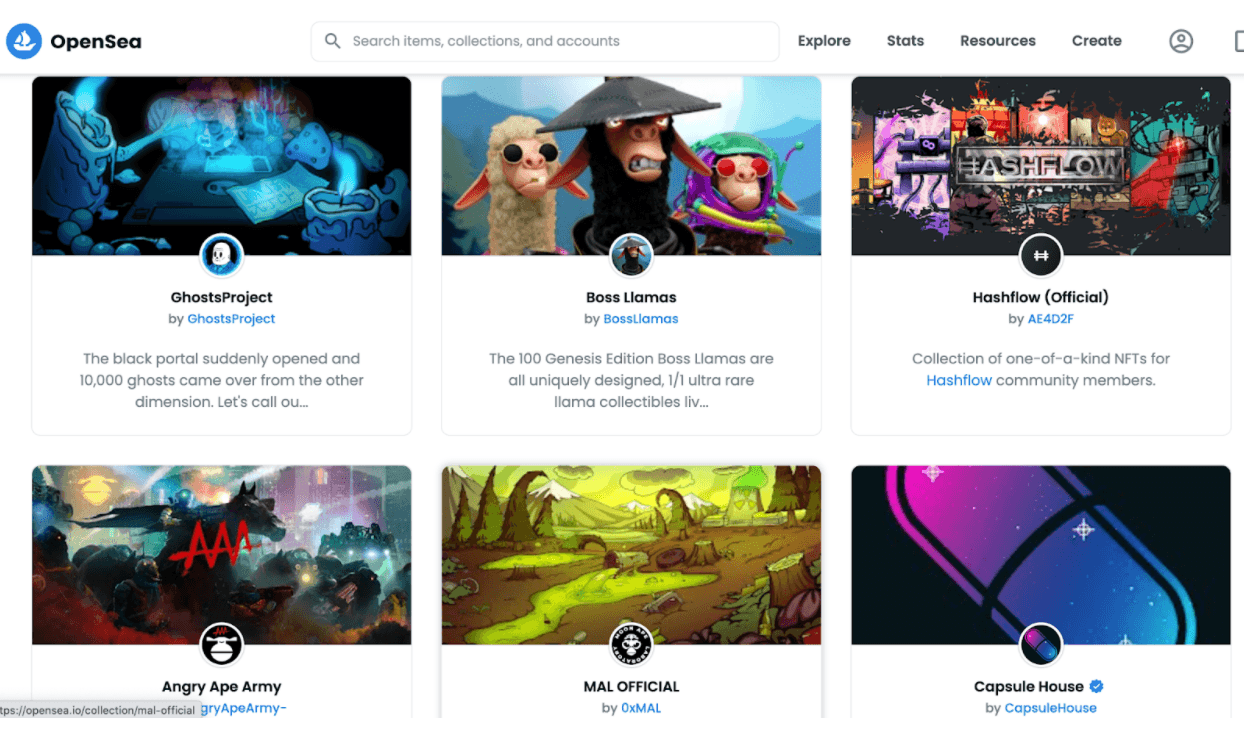

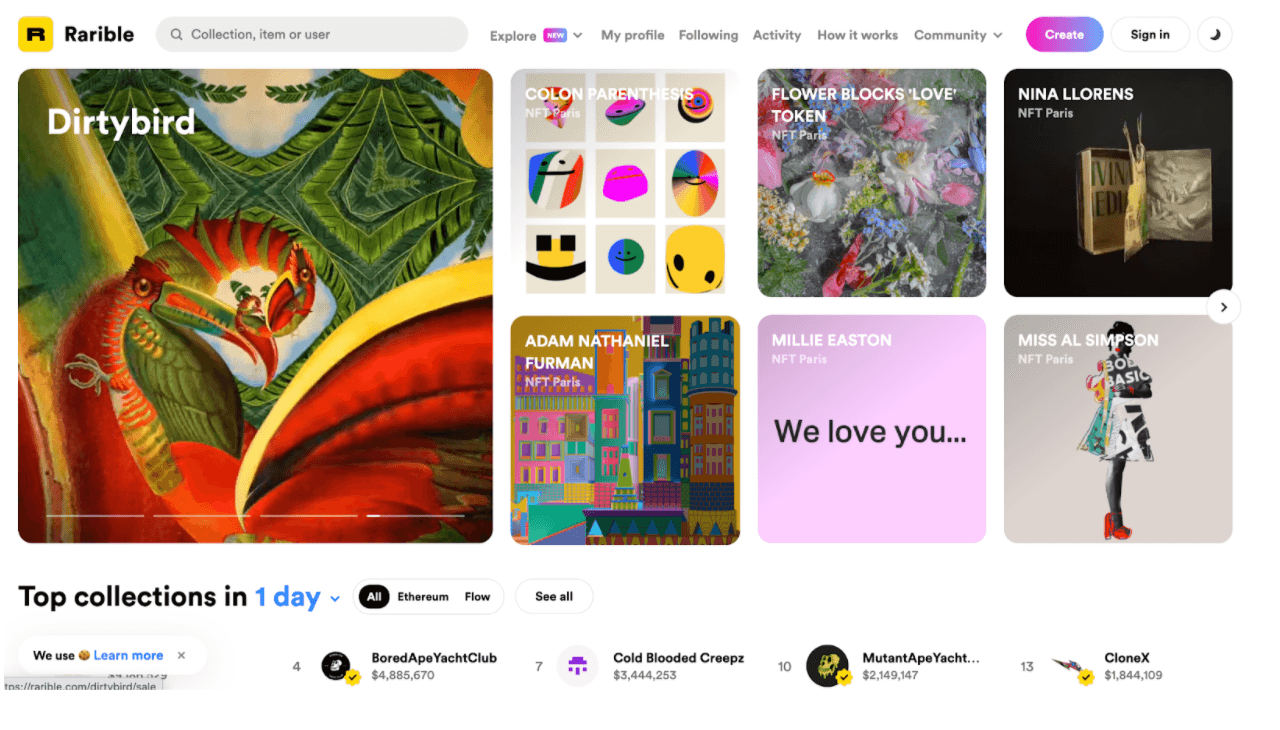

The most popular platforms for creating and trading the non-fungible tokens are Rarible, OpenSea and Mintable. They provide the ability to create custom collections of tokens. You need to have an Ethereum wallet and content that will be linked to the token. Pictures, music, videos, and even 3D models will do. Also, when creating a token, you can add blocked content that only its owner can see.

We’ll demonstrate how it works on the example of one of the most popular OpenSea platform.

- Create a collection for tokens in the "My collections" section, then click on "Create".

- Select the desired image, video or audio on your computer, add a title and description if necessary.

- After creating the collection, you can add a token by clicking the "Add new item" button.

- Select an NFT object, add a name, description, and the number of issued tokens.

- Once created, the token can be sold by clicking on the "Sell" button.

- After setting the price, click on the "Post your listing" button to submit the token for sale. At this point, the platform should debit the publishing fee from the wallet.

- After the publication, the NFT object will be checked, and then users of the platform can buy it. The money from the sale will also come to your e-wallet.

To buy a token, you should decide on the type of NFT you need and choose the right platform. You will need the special cryptocurrency to replenish your wallet on popular marketplaces. On some platforms, you can buy tokens using, for example, USDS or DAI cryptocurrencies.

After replenishing the wallet, you can buy NFT at a fixed cost by simply clicking the "Buy now" button or placing your bid on the auction. If the rate is not higher than yours, the money for the token and the commission will be automatically debited from the account, and the token will become yours. After the purchase, the token goes to your wallet. There, you can view and manage your tokens.

How is an NFT different from Cryptocurrency?

Storing information about the owner and transactions involving NFTs in blockchain chains makes these tokens related to other cryptocurrencies. You also can pass them from one user to another and protect the access with a key. But there are differences between NFTs and other cryptocurrencies, and they are quite significant.

One bitcoin is no different from another, while NFTs are considered non-fungible for a reason. No two NFTs are the same in the digital world: they prove the authenticity of digital items and works of art. In comparison, Bitcoin is a fungible token. You can send one bitcoin to someone else, and they can send it back, and you still have one bitcoin. Since fungible tokens are divisible, you can also transfer smaller amounts of one bitcoin measured in Satoshi (think of Satoshi as bitcoin pennies).

The NFT token itself does not store the product of anyone's creativity: for example, photographs, music, or paintings. It contains only their individual characteristics, which reveal their uniqueness and value. Moreover, using the NFT, it is possible to consider digital and physical objects by analogy with the state register of real estate.

How do NFTs work?

There are various rules for creating and issuing NFTs. The most famous is ERC-721, the standard for issuing and trading non-fungible assets on the Ethereum blockchain.

A more modern improved standard is ERC-1155. It expands the capabilities of digital assets by allowing both fungible and non-fungible tokens to be entered into one contract. Standardization of NFT emission provides a higher degree of interoperability - unique assets can be transferred relatively easily and conveniently between different applications.

The Binance Smart Chain (BSC) network has its NFT standards: BEP-721 and BEP-1155. They provide the same features as the previously mentioned Ethereum standards. However, they are more popular among users, as their cost is much lower.

You can trade NFTs on open marketplaces, including Treasureland, BakerySwap, Juggerworld on BSC, and OpenSea on Ethereum. These markets provide channels for sellers to connect with buyers and trade unique tokens that change in value depending on the market demand.

You can easily create your NFTs using BSC or Ethereum and numerous NFT platforms and exchanges. To do this, you will need some cryptocurrency to pay the creation fee and a digital file that you will turn into NFT. In addition, you have to choose a platform for creating NFTs, for example, Ethereum or Binance Smart Chain.

One of the most interesting examples of non-fungible tokens and the ERC-271 standard is blockchain domains. It is an independent resource network of the traditional DNS domain name system, where you can use the NFT smart contract as the address. Such domains are a completely decentralized system, with the register of matching names and addresses of resources stored not on a central server but the blockchain. You need a specialized open-source IPFS protocol from Protocol Labs to transfer data between such resources.

Decentralized domains can be used to:

- conduct fast crypto transactions since their name is easier to remember than the address of a blockchain wallet,

- create independent data stores managed only by their owners,

- build private means of communication.

At the moment, a decentralized domain can be registered in the .nft, .bit, .zil, .crypto, etc.

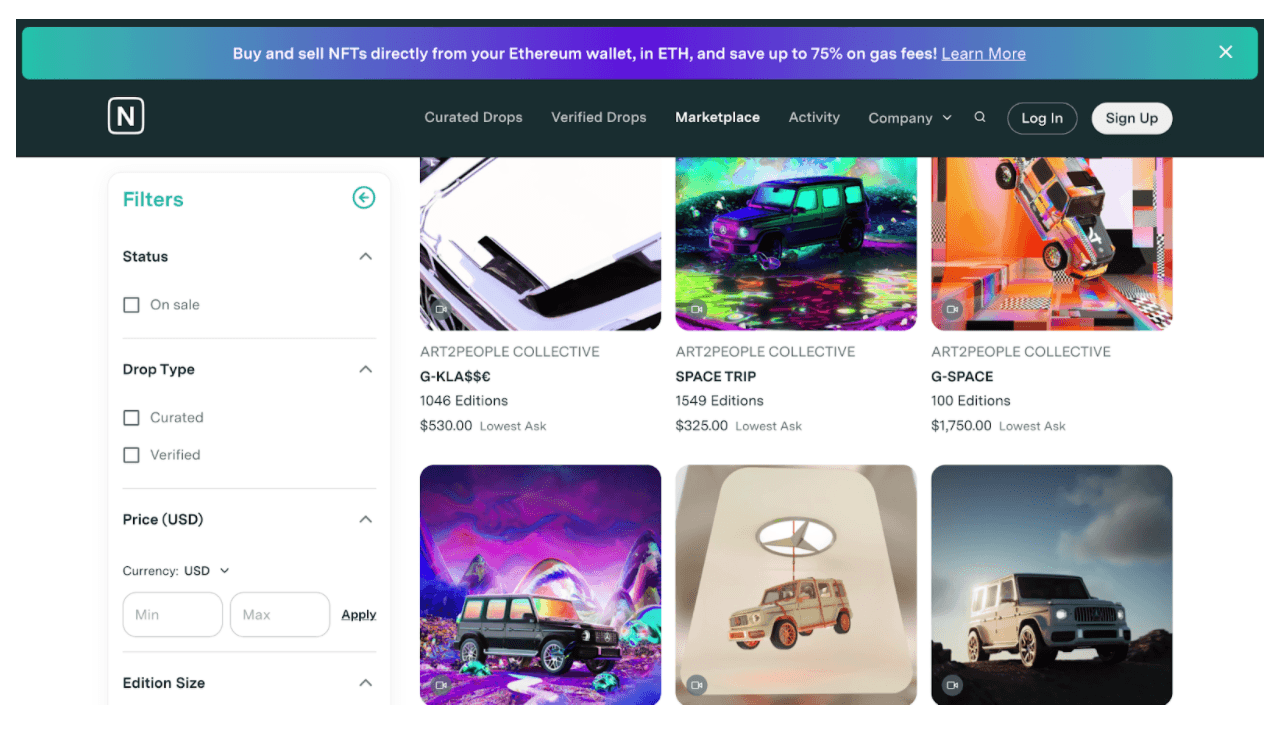

Popular NFT marketplaces

NFT marketplaces are platforms where you can sell, buy, or exchange tokens. They are made specially for non-fungible tokens so that you can store, display, sell and sometimes even create all kinds of digital works here.

We can name some of the most popular NFT marketplaces.

| Marketplace | Features | Total trading volume | Platform | Industry |

|---|---|---|---|---|

| OpenSea.io | Universal platform that allows you to trade all types of NFTs | $649,3M | ETH/Polygon | Сollecting |

| Rarible | platform that allows you to store, create, sell or buy NFTs | $162,98M | ETH | Сollecting |

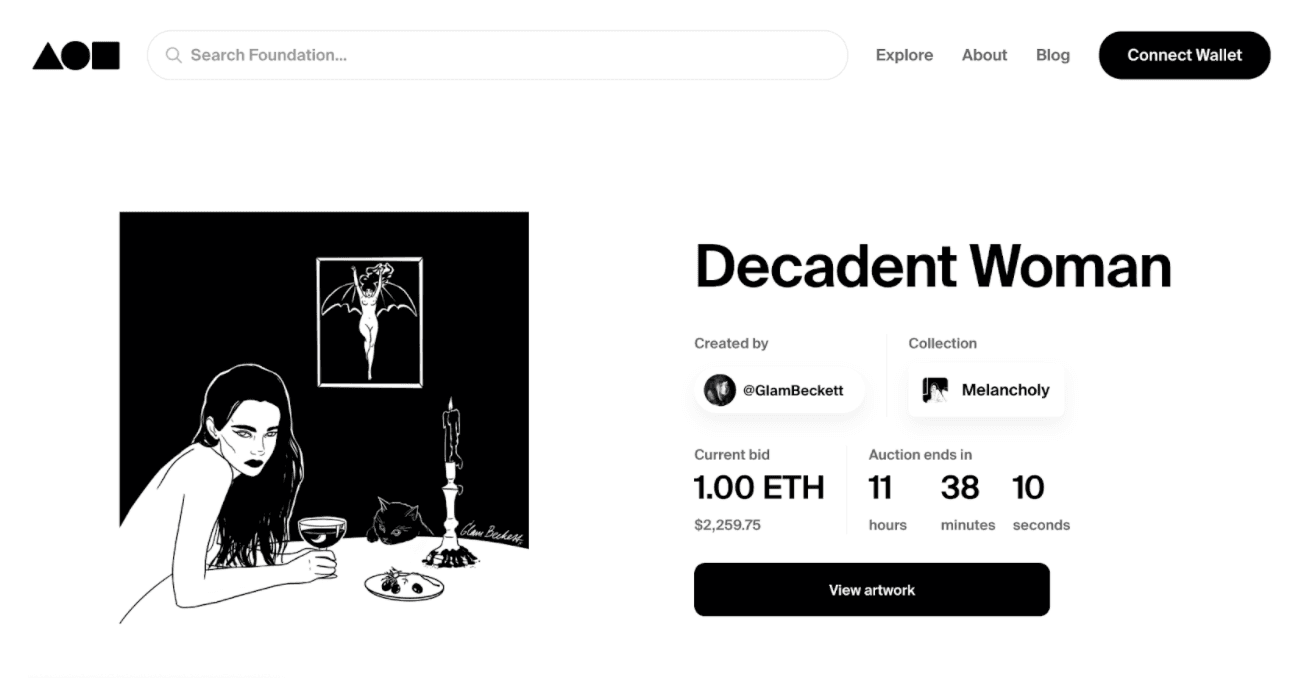

| Foundation | Auction platform | $46,66M | ETH | Сollecting |

| NiftyGateway | Platform that allows you to store, create, sell or buy NFTs using fiat currency | $69,34M | ETH | Сollecting |

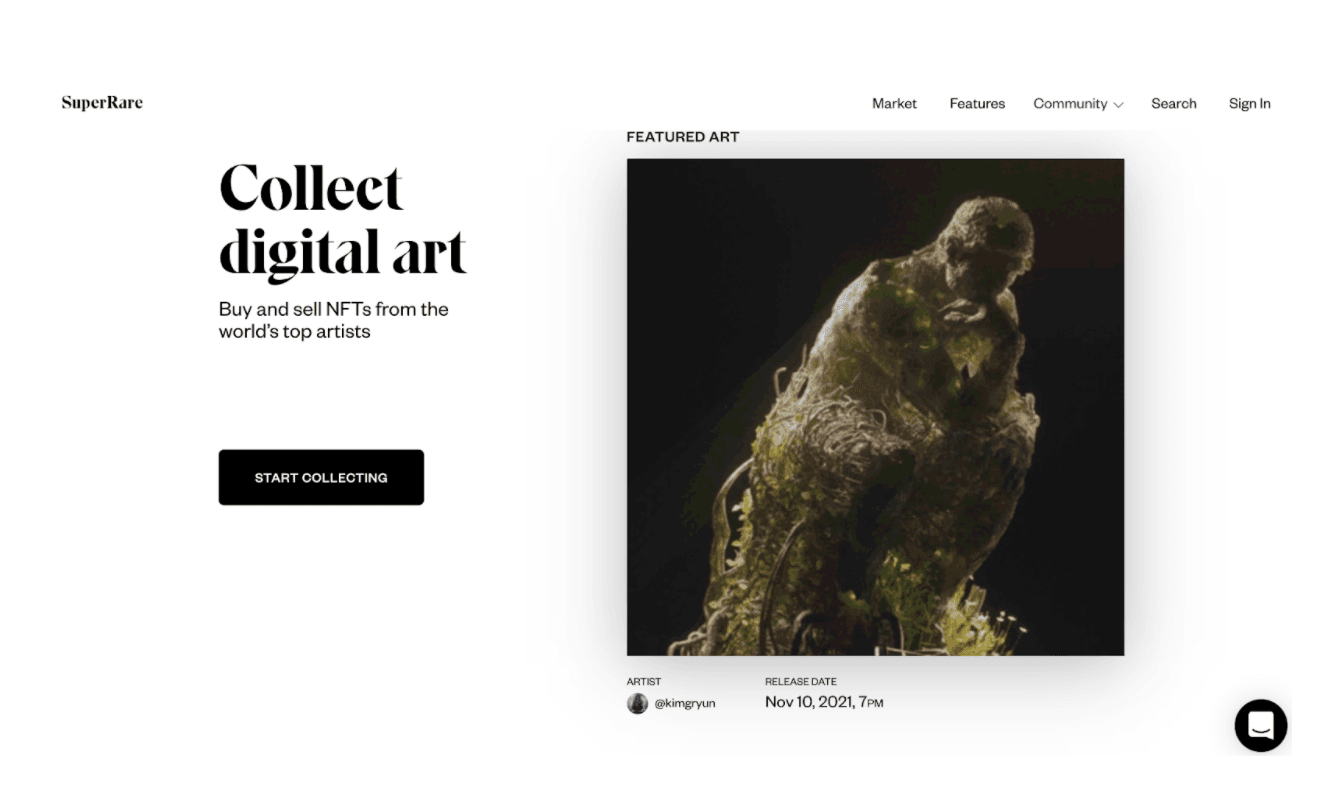

| SuperRare | Platform that allows you to collect rare pieces of art | $74,32M | ETH | Сollecting |

- OpenSea.io is one of the largest and most popular NFT marketplaces today. It provides a variety of offers that overshadows many other trading platforms. Here, you can find thousands of different NFTs: from paintings by contemporary artists to game cards. The platform offers multiple auction features and is fully integrated into the crypto infrastructure.

- Rarible provides one of the highest trading volumes among all NFT marketplaces at the moment. Using the native RARI token, artists can create and sell their work on this platform. Another essential difference is the opportunity for authors to get remuneration every time their work is resold.

- Foundation is an NFT platform with a stylish design for more advanced users. Foundation is an auction site, and to get there, you need to receive an invitation from some author. The auction is held by analogy with the actual public sale of goods. Anyone who has indicated a higher price for a particular time gets a job.

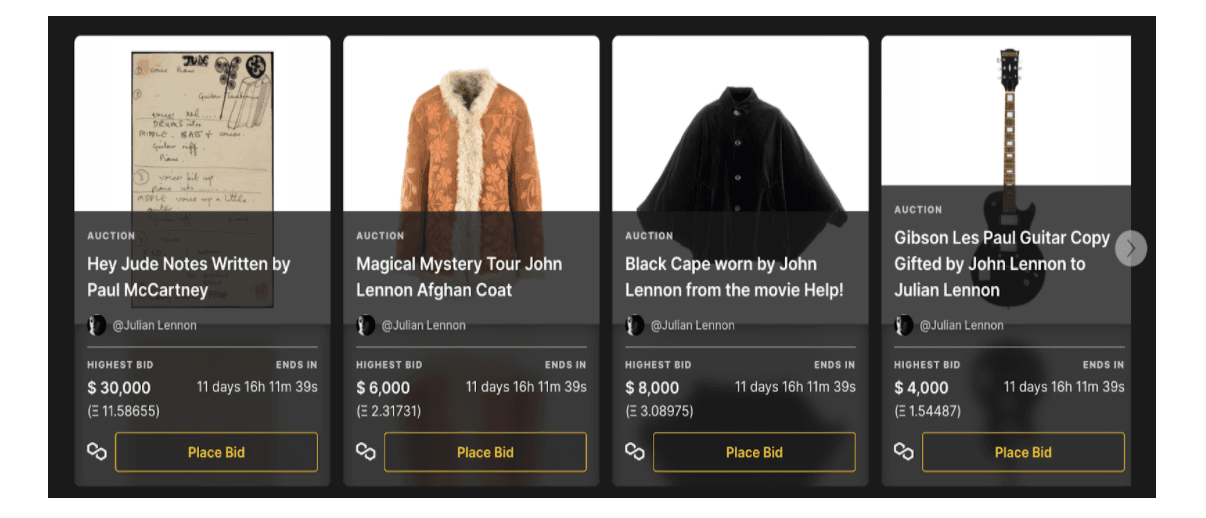

- NiftyGateway offers convenient functionality for buying and selling NFTs, as well as an impeccable reputation. It was bought by the Gemini exchange. The key feature of this site is that users can buy NFT using fiat currency (US dollars, euros, yen, etc.), and sellers can withdraw the proceeds to their credit or debit cards.

- SuperRare is a virtual gallery of digital art. Here, you can find works that artists authentically create on the web. You can regard them as crypto-collectible digital items to own and trade. For the confirmation of their authorship, artists develop a specialized certificate.

The SuperRare platform is not yet fully deployed. However, it recently raised $9 million from investors to further develop and restart next year.

Why Are Non-Fungible Tokens Important?

The total market value of NFT tokens is growing by about $7-9 million every day. Here are some examples where NFT tokens play an essential role:

- Gaming industry, including gambling. The functions of selling, buying, and transferring rare gaming items or skills significantly help to improve the gaming economy.

- Decentralized assets. It can be not only financial but also any kind of asset. In a non-gaming environment, you can use NFT tokens in ENS (Ethereum Name Service) to facilitate the purchase or sale of domains.

- Artists and other creative people can sell works of art to collectors in digital form without the help of promotional houses or art galleries, which allows them to keep most of their profits. It is possible to program NFT so that each time you resell an art object, you can receive royalties. For example, actor William Shatner from the Star Trek series in 2020 released 90,000 digital maps with his photos on the WAX blockchain. Initially, he sold the cards for a dollar. Shatner now earns passive income from each resale of collectible cards.

- Fight against theft of personal data. You can digitize all kinds of information into tokens - about appearance, medical records, education, etc. Thus, attackers' possible forgery of personal data is completely excluded.

Examples of non-fungible tokens

NFTs are associated with digital (and sometimes physical) content, providing proof of ownership. They have many functions and industries of use, including artwork, digital collectibles, music, and items in video games.

- Decentraland is a decentralized virtual world where players can own and trade pieces of virtual land and other NFT game elements. Cryptovoxels is a similar game where you can build, develop and share virtual property. Here, users create and own land, works of art, non-fungible tokens and participate in the decentralized autonomous organization of the platform (DAO).

Thanks to the DAO, the Decentraland community has the right to participate in the management of the project. MANA, Decentraland's native cryptocurrency, and all in-game assets reside on the Ethereum blockchain.

-

Cryptopunks are collectible images that depict a unique 8-bit NFT character. This project started the ERC-721 token standard creation and was one of the first examples of people's passion for cryptocurrency. Since then, CryptoPunks characters have been sold for millions of dollars and inspired many similar projects worldwide.

-

CryptoStamps are issued by the Austrian Post and connect the digital world with the real world. These stamps are used to send mail, like any other stamp. They are also stored as digital images in the Ethereum blockchain, providing a digital collectible to buy.

-

Genesis Estate - this is an example of selling a virtual piece of land on the blockchain marketplace and gaming platform Axie Infinity. Recently, one user bought nine lands for $1.5 million. It is not the only NFT available in the game. The main game assets are the Axies - the characters who live on this purchased land in the virtual world. Each of them is unique, and you can buy, sell, raise them in the virtual space. These characters are also NFT tokens.

-

Software licensing. According to experts, creating licenses based on NFTs could reduce piracy and allow people to sell their licenses on the open market for profit. In this way, users can also avoid yearly subscriptions, use the software against the purchased license, and sell it to someone else after use. The license, in this case, acts as an asset for users.

-

YellowHeart - a ticket with access to an event or a coupon. The purchase of digital tickets for a concert, football match, or any other event. They can be used as souvenirs or, for example, an autograph of a celebrity.

Things to consider before buying NFTs

As the NFT industry develops, you will likely encounter many updates and information every day. To help you, we'll outline four things you should consider before buying anything on an NFT marketplace.

- Type of NFTs you are interested in.

Before diving into the world of NFTs, it is essential to understand what type of NFTs to choose. There can be further division within the categories into sub-categories, including NFTs, which can be considered premium (for example, created by established artists) and more basic (created by any other authors). The place you choose to buy your NFTs will largely depend on the type of NFT collection.

- Liquidity and Market Size

Remember that buying NFT is different from buying bitcoin, which is always liquid due to the large market volumes on cryptocurrency exchanges. The type and popularity of the purchased NFTs influence its liquidity. You may face long-term low liquidity, low demand for the asset, or the anticipation of its value growth.

- Transaction fees

Transaction fees vary greatly and can have different meanings on different platforms. If we mean all additional costs for sale deducted to the platform or author, then on average, it turns out that the commission on NFT platforms varies from 2.5% to 15%. That’s why it’s better carefully consider possible additional costs that may arise during a particular NFT transaction.

- Experience

Many NFT marketplaces are just platforms for exchanging digital assets on the blockchain. Meanwhile, NFT-related experience can be much more extensive. NFTs open up many possibilities in the real and digital worlds.

The NFTs is developing industry with its possible challenges and risks that may include:

- You need at least a basic understanding of blockchain technology to use assets.

Meanwhile, most people are interested in the token's value rather than the underlying technology. - The ease of management depends entirely on the scalability of blockchain technology.

- Plagiarism is possible. Once created, an NFT token can neither be counterfeited nor stolen. But do not forget that this is not a physical and not even a virtual object of sale. It is a secure certificate of the right to this object. Therefore, it costs nothing for an attacker to copy an entity tied to an NFT and create their token for this copy.

NFTs and Defi (Decentralized Finance)

Decentralized Finance (DeFi) is a decentralized and public ecosystem of financial applications and services based on public blockchains, primarily Ethereum. The DeFi ecosystem includes all aspects of financial services and transactions, like lending, borrowing, and trading within decentralized structures. Any Internet user can interact with the ecosystem and maintain assets through peer-to-peer (P2P) and decentralized applications (dApps).

The DeFi applications allow you to borrow money by using NFTs as collateral. So, if you buy a rare CryptoPunk NFT, you can fetch $1000s. You can maintain a loan with the same ruleset by using it as collateral. And If you don't pay back the DAI, the lender will get your CryptoPunk as collateral. It can be applied to any tokens you choose.

NFT users can also generate "shares" for their NFT. That’s how you can own a part of an NFT without buying the whole thing. The main aspects include:

- You can trade fractionalized NFTs on DEXs like Uniswap. It results in more buyers and sellers.

The price of its fractions defines the overall price of NFT. - You can own and profit from items that are important to you.

- There are still experimental fractional NFT ownership exchanges like NIFTEX and NFTX.

NFTs predictions for 2022

Currently, the non-fungible tokens are focused on art, games, and crypto-currency collectibles. Increasingly, popular brands are licensing their content to NFTs. The football game Sorare has registered more than 100 football clubs on its platform. Twitter launched its NFT collection in June 2021, and a few months later, it announced plans to validate NFT user avatars.

If we say about the NFTs development now, we can see the following trends:

- Many NFT followers see the future of tokens in higher integration with the real world. In the digital world of Decentraland, Decentral Games is building a digital online casino where people can play poker tournaments. Buying and selling NFT items will earn you a seat at specific high roller tables.

- After high-profile NFT sales from well-established artists, the market flooded with lesser-known art. Some critics believe that NFTs are just temporary success. Others say that the large influx of consumers and merchants will eventually shorten, and only genuinely unusual NFTs will retain their value.

- NFTs create opportunities for new business models that didn't exist before. Artists can attach terms and conditions to NFTs that ensure they receive their share on every resale, which means they will benefit if their work rises in value.

- The potential of NFTs goes much further because they completely change the rules of ownership. Transactions recorded on blockchains are secure because you can’t change the information. Smart contracts can be used instead of lawyers and ensure all party's agreements. NFTs convert assets into tokens so they can move within this system.

- NFTs have the potential to transform markets such as real estate and automobiles completely. They can also be part of the solution to land tenure problems. Only 30% of the world's population has legally registered rights to their land and property. It is much more challenging to access finance and credit for those who don't have well-defined rights.

- A further application of NFTs could be certification such as qualifications, software licensing, and even birth and death certificates. A non-fungible token smart contract invariably confirms the identity of the recipient or owner and can be stored in a digital wallet for easy access and presentation.

The image shows the NFT sales value in the USA in the art segment on January 2022.

You can use NFTs to represent in-game items, with the possibility to carry or trade them to the new games and other players. However, their potential is much more significant. Possible applications include copyright and intellectual property rights, ticket sales, and the sale and trade of video games, music, and films.

NFTs add the potential to create security tokens and tokenize both digital and real assets. Physical assets such as property can be marked for partial or shared ownership. If these security tokens are not fungible, ownership of the asset is fully traceable and transparent, even if only tokens representing partial ownership are sold.

Moreover, the largest fintech companies in the world (TikTok, Twitter, Microsoft, eBay, Tencent, Alibaba) and cryptocurrency exchanges (Coinbase, Binance) are joining the fight for the NFT market. All this suggests that the future of NFT is still ahead: both new price records and new regulations.

Feel interested? Let's talk and see how we can grow your business together and attract your customers.